“Lions and Tigers and Bears, OH MY.” That is what I think of when I read the title of this post. Let’s face it (together), unless you are Bill Gates, Warren Buffet (though he is rumored to be quite thrifty) and the like you have probably accumulated some holiday debt. Which again means one or two things: you were very generous (maybe overly so, I know I was) OR you didn’t have the money saved to begin with and relied on credit cards to fund your generosity OR any combination of the two and then some. First of all good for you! I will never fault anyone for being generous, EVER! I personally LOVE finding that one gift I know a loved one will love and when I do, I rarely look at the sticker price or even give it a consideration. With that being said, NO, I don’t care how much you love that Lamborghini, you are not getting that from me! 🙂

Here are 5 steps to help you get back on the saving track (always the #1 financial priority, in WMR’s opinion) and reduce your debt simultaneously. Win-Win in WMR’s book!

I am not going to state the obvious (well maybe I am) but if there was a -1 step it would be:

DO NOT ACCUMULATE ANY NEW DEBT FROM THIS POINT FORWARD 🙂

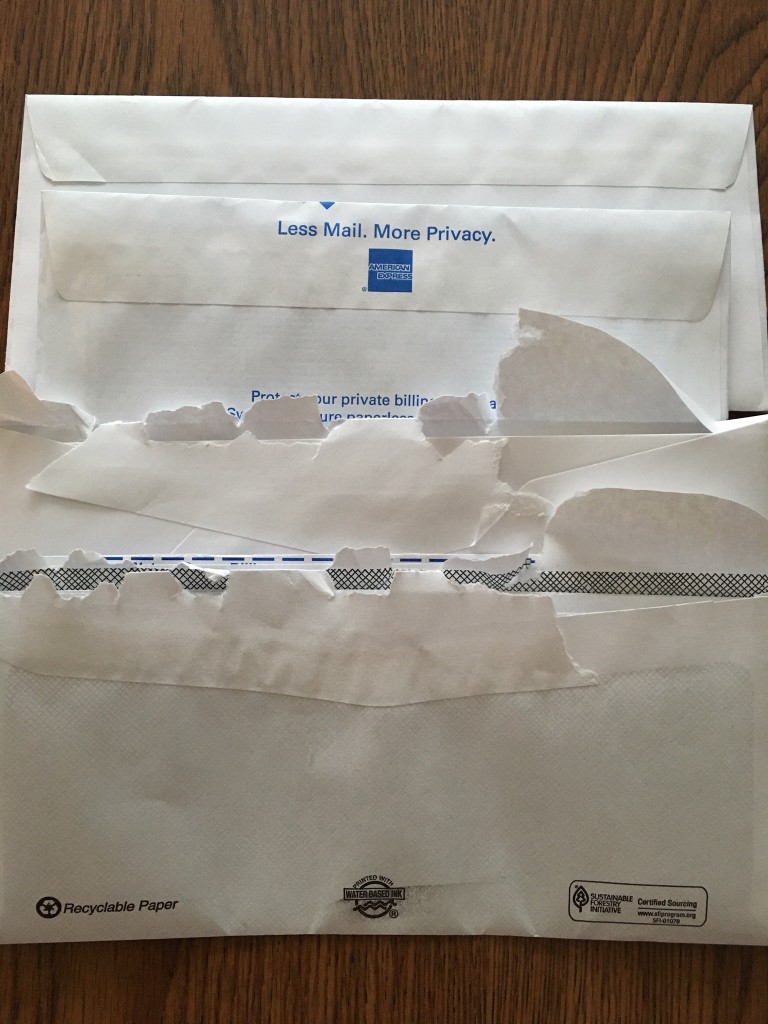

- LAY IT ALL OUT RIGHT IN FRONT OF YOU! I know, I know! This may sound arbitrary but it is definitely the #1 way to fool yourself into thinking you have less debt than you have if you do not do this step first. Find a nice big surface like the kitchen table and lay out your receipts, your credit card bills, match them up and move on to step 2!

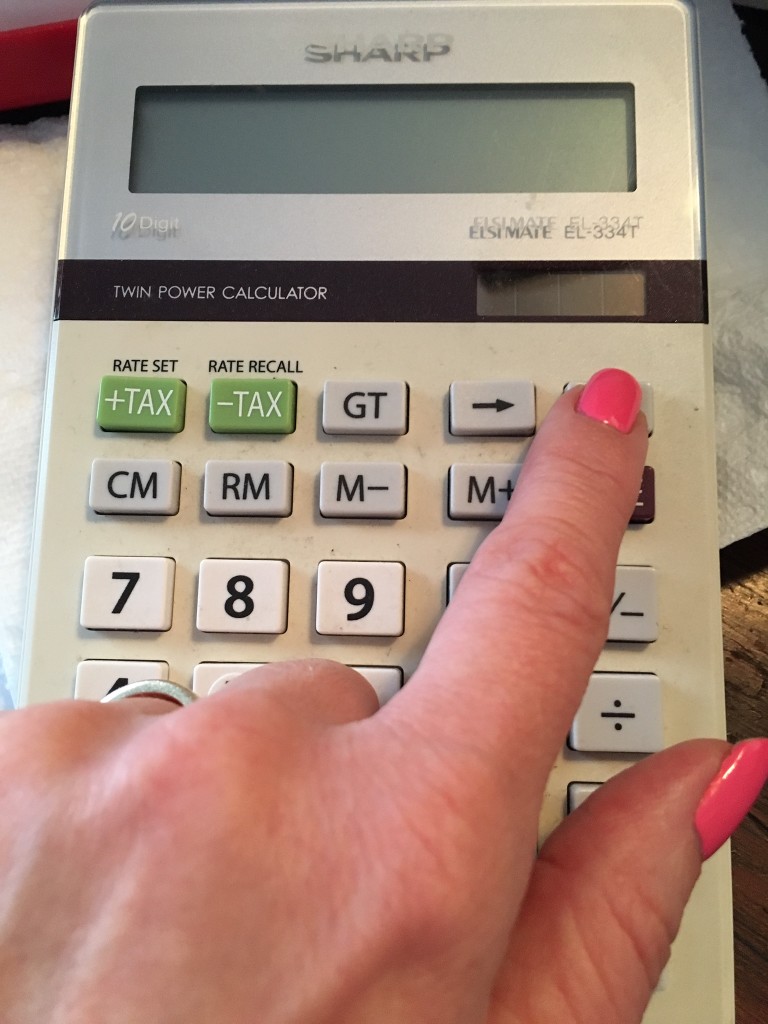

Nicely lay them out! - So of course your second step would be to TALLY THOSE BILLS UP! Arbitrary and Duh sounding again, YES! Unequivocally necessary, YES!!

Tally! - On to step 3, CREATE A STRATEGIC PAY DOWN PLAN! I have again included my free Financial Spreadsheet to help you get this done. This spreadsheet is fully customizable and I put some figures in it to get you started. This step is a little more in-depth so let me expand upon it:

(A). Fill in your fixed expenses first, the column farthest left, make sure to include emergency savings in there even a little amount. If you take the savings right off the top, chances are you won’t even miss it. (B). Next estimate what your variable expenses will be for the month. This includes: food; gas; entertainment and so on and input them into the spreadsheet. This will leave you with the net income you have to work with to pay down your bills. (C). You have a few options now: 1. pay down the lowest balance first, provided the interest rate isn’t too high 2. pay down the one with the highest interest rate, not necessarily the one with the highest balance first or 3. any combination of the two. Use a free financial calculator found on the www to see how much you will be paying in interest overall to help you decide which approach to take as well. Most credit card statements now include the pay down breakdown with your monthly statement. - MONITOR DILIGENTLY YOUR PAY DOWN PLAN! Hopefully by step 4, you will have a better grasp of how much you owe and how long it will take for you to pay off your holiday debt. As with everything in life think of this as a learning experience. Nothing ventured, nothing gained, nothing more!

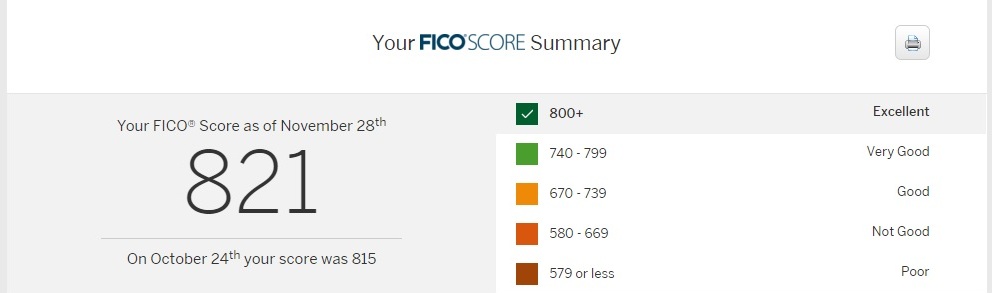

The Magic 8 Ball won’t help you here! - MODIFY YOUR PAY DOWN PLAN AS NECESSARY! Things happen, that is called life! For example if you can’t pay more than the minimum on a bill because you had an unexpected car expense, don’t sweat it! BUT please always make the minimum payment to maintain a good credit score as we have found out is very important!

Scoring Chart

I am a goal orientated kind of woman, I believe we all are! So when I think in terms of saving or paying down debt sometimes the joy of it, just isn’t enough. I need something else. For me that something else is always mainly traveling, this year it is Disney World with my Family, next year who knows but I do know I will be prepared, so will you!! 😀

Kimberly

Latest posts by Kimberly (see all)

- No Spend January - January 1, 2025

- Hot Artichoke Dip with Crostini - January 1, 2025

- Reduce Holiday Debt While Simultaneously Saving Money (Even A Little Bit Counts) - January 1, 2025