Excerpt from About Kim:

I have been a certified Financial Counselor and believe with my whole heart, brain and soul that women have the responsibility to ALWAYS maintain even a minimal level of competence in their financial life.

On this particular topic let me just start out by saying I am the LEAST lenient! For me it is black and white with no areas of gray. When my parents divorced, my Mom was 33 years old. She was now a single mother of 4. Without knowing it at the time she was setting an exemplary financial example for me through osmosis that I have followed my entire life. With that intro I impart our (Margie and I) first rule of financial management:

Know Where Your Hard Earned Money Goes!!

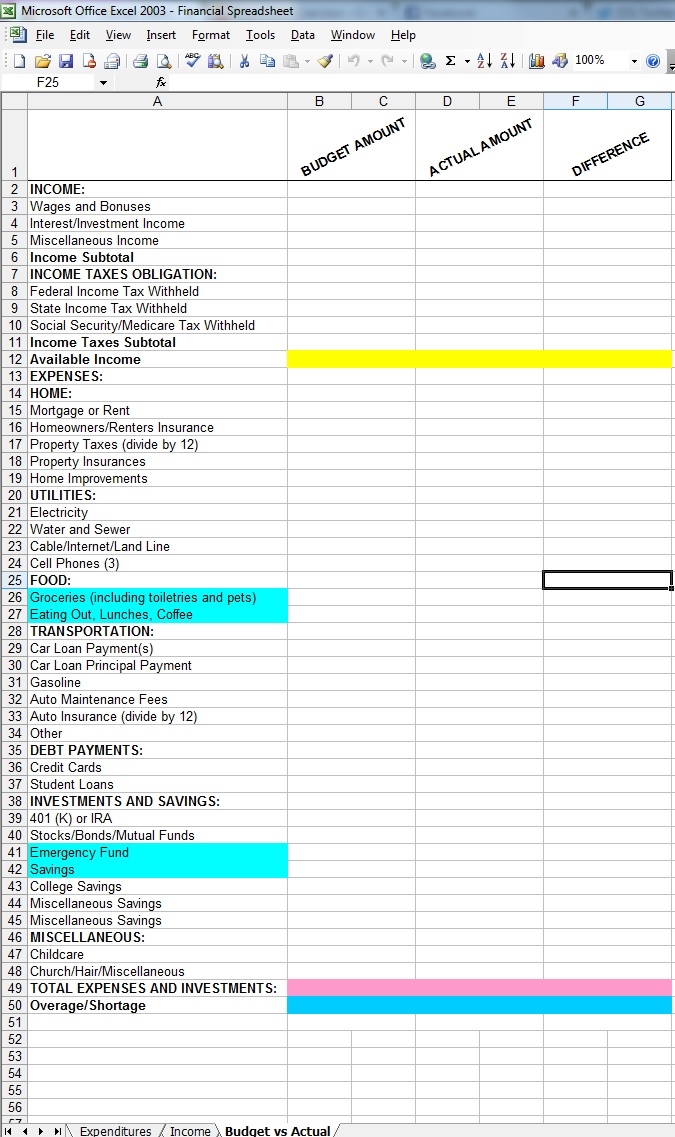

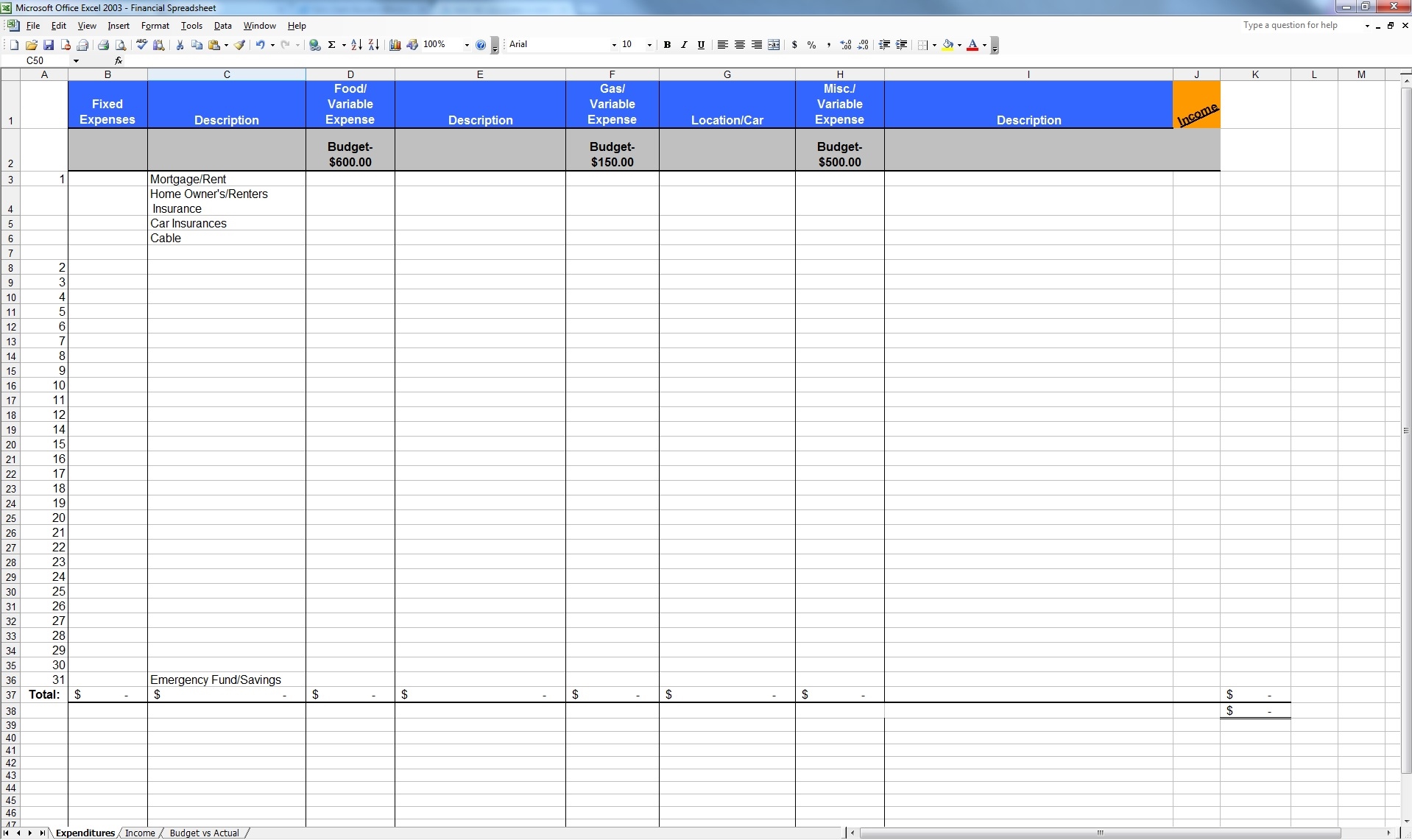

Most of the experts say and with good reason: the first rule of financial management is to have a budget. I believe that is the second rule. As Woman Market Ready is geared towards every “woman” as an individual it only makes sense that every woman’s financial budget should be as well. Trend with me on this. A normal budget spreadsheet appears something like this:

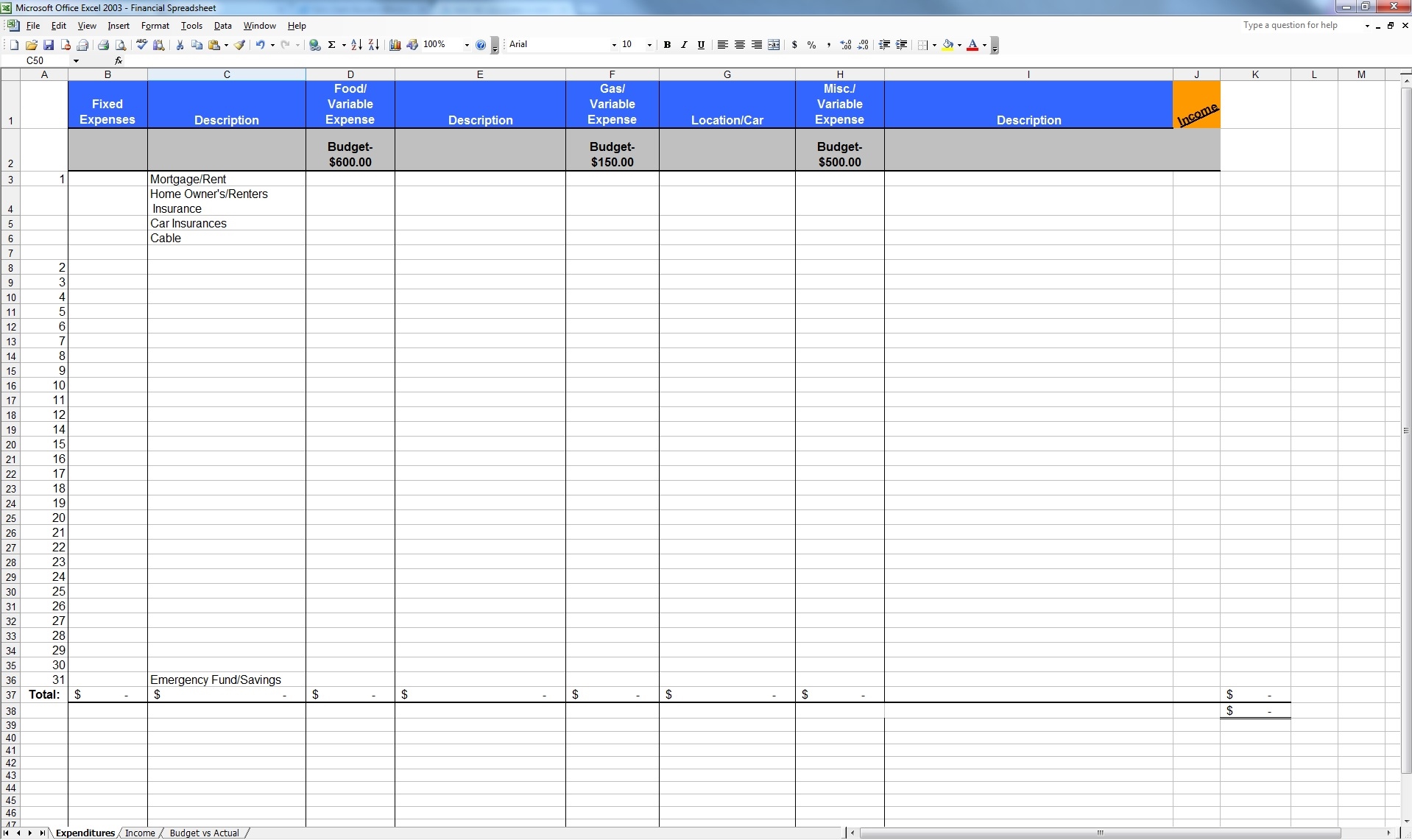

You have your fixed expenses, your hierarchies which include: rent/mortgage payments and all applicable insurances & expenses; car payments and all applicable insurances & expenses and so on. Then you have your variable expenses again with its own hierarchies which may include: groceries; cell phone; cable; entertainment and so on. But in order to get to the budget process above you need to first know where your hard earned money goes. NOT only that I repeat, BUT where do you WANT your hard earned money to go. Insert here my financial spreadsheet!

The following is an example of a 1/2 month’s potential input data.

Here are five tips to successfully use this tool:

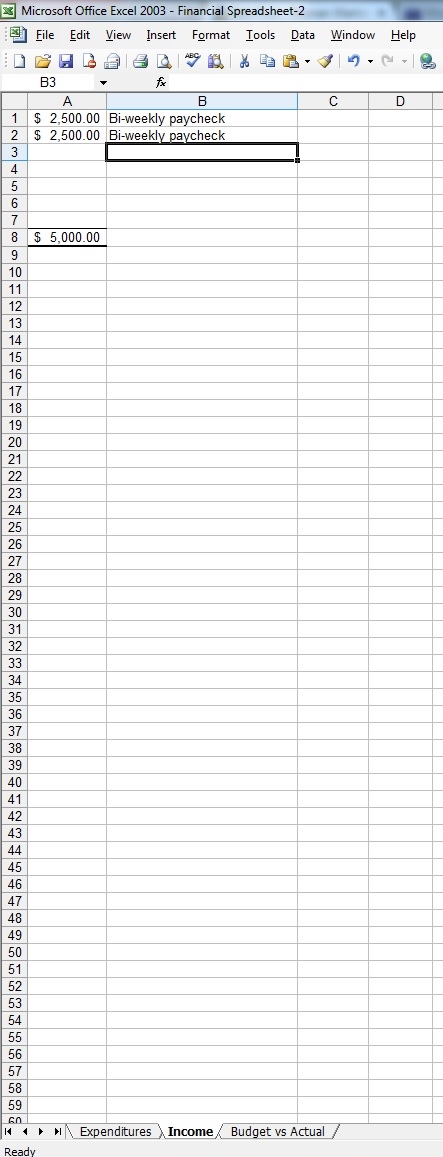

Note, there are three tabs or worksheets located at the bottom of the spreadsheet.

- Use the income sheet to calculate your monthly earnings. Include all sources of income then copy and paste the amount from this worksheet into the income cell on the expenditures worksheet.

Income Worksheet - When you first start tracking your expenses be very specific. Track it all! From the pack of gum you buy at the convenience store to the pocketbook you buy on ebay, and everything in between. Note I said: when you first start. As you become very aware of where your hard earned money is going you can lump some of the expenses into one category such as misc. so you don’t have to be SO stringent.

- Take a mid-month inventory of spending. I purposely only included an example of a half month’s data to give you a visual reminder to check and recheck to make sure your spending is on par with your income.

- PAY YOURSELF FIRST!! Note: under fixed expenses I listed Emergency Fund/Savings. I can NOT emphasize enough how important it is to have money in the bank!! I personally have been through a gamut of circumstances including but not limited to: leaving a job that did not suit me to pursue another; being laid off during an economic downturn; taking a leave of absence to care for my dying Mother and so on. My point is none of those events, in my control or otherwise, were able to financially devastate me because I was prepared for the expected and unexpected!

- Think of this exercise as a journey not a destination. Over the years my “wants” and “desires” have consistently changed as I have. Isn’t it said the one constant is change. But what hasn’t changed is my desire to keep on learning all I can about finances and especially my own finances! As each journey, financially speaking or otherwise, is individual to each woman there is no “gray” area I repeat on our financial responsibility to ourselves. Be Woman Market Ready, you deserve nothing less!!!

Remember life is the market, be ready!

Download your free Excel Spreadsheet and start tracking! 🙂 Financial Spreadsheet

Kimberly

Latest posts by Kimberly (see all)

- No Spend January - January 1, 2025

- Hot Artichoke Dip with Crostini - January 1, 2025

- Reduce Holiday Debt While Simultaneously Saving Money (Even A Little Bit Counts) - January 1, 2025

5 thoughts on “MARKET READY-Take 4-FINANCE”

Thank you for the Spreadsheet. I know this is something I should’ve been doing a long time ago but have not been so disciplined about it. Especially at times when money wasn’t as much of a worry but today I need to be better about it. The spreadsheet is a great start!

Robyn, we women are in this together!! Happy computing 🙂

Kim. Thanks for sharing this. It really is a great tool to use have used others but like this one a lot!!

Kim this is a great financial tool. Have tried others but really like this one!! Thank you!!!

So great to hear!!! 🙂

Comments are closed.